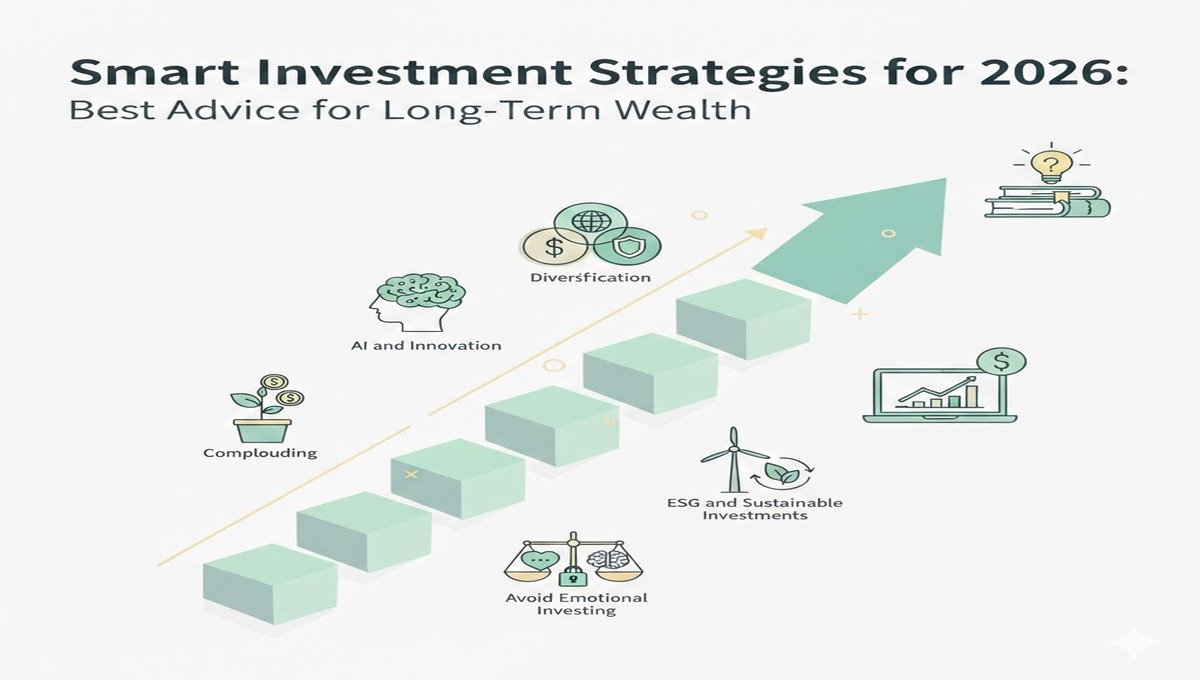

Investing wisely is one of the most effective ways to build lasting wealth. As we enter 2026, the financial landscape continues to evolve rapidly, influenced by global economic changes, technological advancements, and emerging market opportunities. To achieve long-term growth and financial security, it’s crucial to follow smart strategies that maximize returns while managing risk effectively.

In this article, we’ll explore the best investment advice for 2026 and practical steps you can take to grow your wealth sustainably.

1. Diversify Your Portfolio Across Assets and Markets

One of the most important principles of investing is diversification. Spreading your investments across multiple asset classes and markets helps reduce risk while providing opportunities for growth.

- Asset Diversification: Consider a mix of stocks, bonds, real estate, and alternative assets such as commodities or precious metals.

- Geographical Diversification: Investing globally can protect your portfolio from regional economic slowdowns. Emerging markets, in particular, may offer high growth potential, though they can be more volatile.

- Sector Diversification: Technology, healthcare, renewable energy, and fintech are sectors expected to grow strongly in 2026. Allocating a portion of your portfolio to these sectors can enhance long-term returns.

A well-diversified portfolio balances risk and reward, providing a solid foundation for wealth accumulation.

2. Focus on Low-Cost Index Funds and ETFs

For long-term investors, low-cost index funds and ETFs remain a smart choice. These funds track major indices like the S&P 500, providing broad market exposure and instant diversification.

Benefits include:

- Lower management fees compared to actively managed funds

- Consistent market-aligned returns over time

- Reduced risk from investing in a single stock

For investors aiming to grow wealth steadily, these funds offer an efficient and low-stress approach to long-term growth.

3. Leverage the Power of Compounding

Compounding is one of the most powerful tools for wealth creation. The earlier you start investing, the more your money grows over time.

- Start Early: Even small contributions accumulate significantly over the years.

- Reinvest Earnings: Dividends and interest should be reinvested automatically to boost growth.

- Stay Committed: Avoid withdrawing your funds prematurely to allow compounding to work its full potential.

Time is a key factor in building long-term wealth, and consistent investing amplifies its benefits.

4. Include ESG and Sustainable Investments

Environmental, Social, and Governance (ESG) investing has gained momentum in 2026. Investors increasingly look to support companies that are sustainable, ethical, and socially responsible.

Why ESG matters:

- Companies with strong ESG practices often show better long-term performance

- ESG investments reduce regulatory and reputational risks

- Many ESG-focused funds provide competitive returns while promoting sustainable practices

Incorporating ESG assets into your portfolio allows you to grow wealth responsibly.

5. Explore Technology and Innovation

Technological innovation continues to create exciting investment opportunities. Sectors like artificial intelligence, blockchain, biotech, and renewable energy are expected to thrive in 2026.

- Growth Stocks: Allocate a portion of your portfolio to companies driving innovation.

- Tech ETFs: These funds offer exposure to multiple high-growth companies without the risk of betting on a single stock.

While high-growth technology investments can be volatile, they also offer significant potential for long-term wealth accumulation.

6. Maintain an Emergency Fund

No investment strategy is complete without liquidity. An emergency fund ensures you can handle unexpected expenses without liquidating your investments at a loss.

- Keep 3–6 months of living expenses in a high-yield savings account

- Keep your emergency fund separate from your long-term investments

Liquidity protects your portfolio from short-term shocks and allows you to stay invested for the long term.

7. Avoid Emotional Investing

Emotions can be a major obstacle to successful investing. Market fluctuations often tempt investors to make impulsive decisions, such as panic selling during downturns or chasing hot trends.

- Stick to your long-term investment plan

- Rebalance your portfolio periodically

- Focus on fundamentals, not short-term market noise

Discipline and patience are essential for growing wealth sustainably.

8. Continuous Learning and Expert Advice

Markets and investment strategies evolve constantly. Staying informed and seeking expert guidance helps you make smarter decisions.

- Read financial news and market analysis

- Take online courses or attend webinars on investing

- Consult certified financial advisors for personalized strategies

Knowledge combined with disciplined action can significantly enhance long-term results.

FAQs

Q1: What is the best type of investment for beginners?

A: Low-cost index funds and ETFs are ideal for beginners because they offer diversification, lower risk, and consistent long-term returns.

Q2: How much should I invest each month?

A: It depends on your income and financial goals, but many advisors recommend investing 10–20% of your monthly income consistently.

Q3: Are ESG investments profitable?

A: Yes. ESG investments often provide competitive returns while supporting ethical and sustainable practices.

Q4: Should I invest in individual stocks or funds?

A: Funds like ETFs and index funds offer diversification and lower risk, while carefully chosen individual stocks can add growth potential.

Q5: How do I deal with market volatility?

A: Stay calm, avoid panic selling, and focus on your long-term investment strategy. Regular portfolio rebalancing helps manage risk.

Conclusion

The best investment advice for 2026 centers on diversification, disciplined investing, and staying informed. By leveraging low-cost funds, harnessing compounding, exploring ESG opportunities, and embracing technological growth, investors can build a portfolio designed for sustainable long-term wealth.

Investing is a journey that requires patience, learning, and strategic planning. With the right approach, 2026 can be a year where smart decisions lead to lasting financial success.