Every modern entrepreneur knows that capital is the fuel of growth. Whether you’re launching a new startup, scaling your operations, or navigating unexpected market shifts, having the right Funding strategy in place is essential. But with a growing variety of loan products and funding sources available today, choosing the best options can be confusing and overwhelming.

In this comprehensive guide, we’ll break down smart loans and funding strategies tailored for today’s entrepreneurs—helping you make informed financial decisions that drive results.

Why Funding Strategy Matters

Before we dive into specific options, let’s clarify why having a strategic funding approach is so important.

Your funding strategy:

- Shapes the pace of your growth

- Determines how much control you retain over your business

- Influences your profitability and cash flow

- Affects your ability to withstand market uncertainties

Instead of simply finding money, smart entrepreneurs plan how and when to access capital so that it works for the business, not against it.

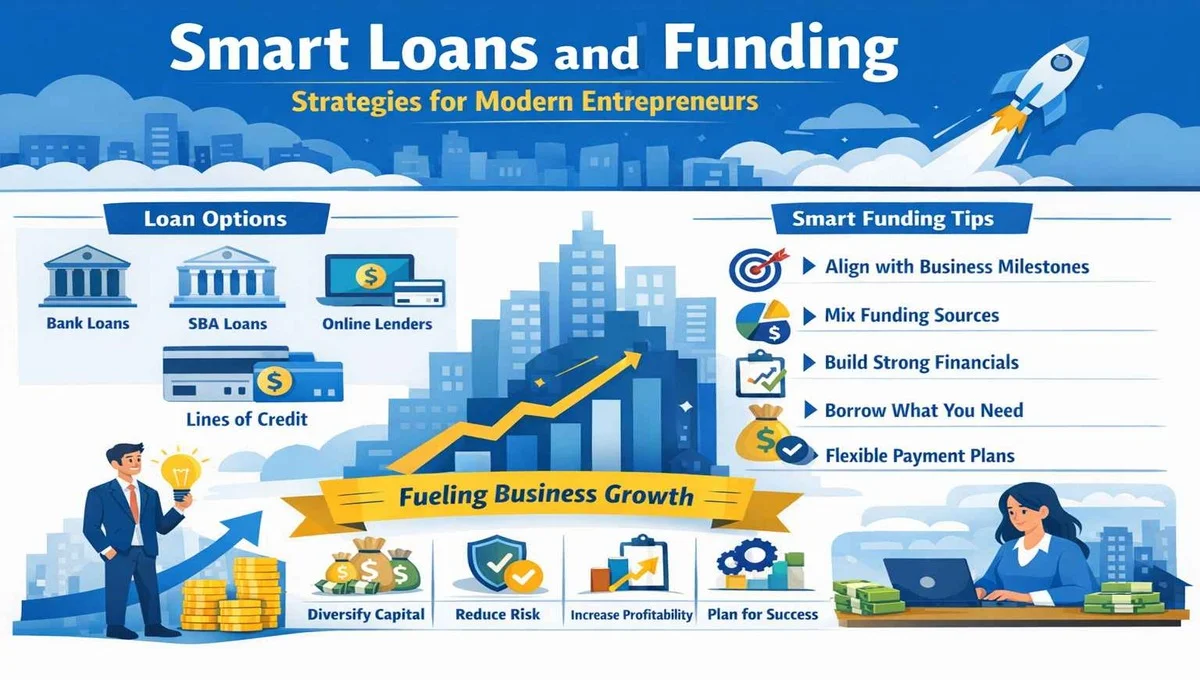

Common Loan Options Every Entrepreneur Should Know

Here are the key loan types that modern businesses rely on:

Traditional Bank Loans

Traditional bank loans are often seen as the gold standard for business financing because they typically offer lower interest rates and longer repayment terms. However, they also require strong credit histories, detailed financial documentation, and time‑intensive approval processes.

SBA Loans

Small Business Administration (SBA) loans, such as the 7(a) or CDC/504 programs, are government‑backed loans designed to make financing more accessible and affordable. These loans generally have competitive interest rates and can be used for many business needs including working capital, equipment, and expansion.

Online Lenders & Alternative Financing

Online lending platforms offer fast approval and more flexible criteria than traditional banks. While interest rates may be higher, these options are excellent for businesses that need cash quickly or don’t qualify for bank financing.

Alternative financing options can include:

- Invoice factoring

- Short‑term loans

- Merchant cash advances

- Revenue‑based financing

Lines of Credit

A business line of credit works like a financial safety net: you get access to funds up to a pre‑approved limit and only pay interest on what you actually use. This is one of the most flexible financing tools for unpredictable cash flow needs, seasonal expenses, or opportunities that require quick action.

Smart Funding Strategies for Growth

Knowing your options is only half the battle. To capitalize on loans and funding effectively, apply strategic thinking throughout the funding process.

1. Align Funding with Business Milestones

Don’t take on debt just because funds are available. Tie your financing decisions to specific business milestones like:

- Expanding into new markets

- Hiring key talent

- Launching a new product

- Upgrading equipment

This ensures your funding is purposeful and ROI‑driven rather than reactionary.

2. Mix Your Funding Sources

Diversification isn’t just for investment portfolios—it’s smart for financing too. Leaning on a single funding source exposes your business to risk. A mix of loans, lines of credit, and alternative funding gives you stability and flexibility as your needs evolve.

For example, you might pair:

- An SBA loan for long‑term expansion

- A line of credit for short‑term cash flow

- Invoice financing to manage receivables

This reduces dependency on any one funding channel and gives you flexibility when opportunities arise.

3. Build Strong Financial Documentation

Lenders want confidence that you can repay what you borrow. That’s why maintaining clean, organized finances is crucial. Make sure you have:

- Updated income statements

- Cash flow statements

- Profit & loss reports

- Clear business plans with projections

Strong documentation not only improves approval odds—it can also help you negotiate better rates and terms.

4. Borrow What You Need (Not More)

It’s tempting to take all the funds you qualify for—but borrow only what you need. Over‑leveraging your business increases risk and ties up future cash flow in repayment obligations.

Instead, forecast your capital needs and take a conservative approach to borrowing. This discipline protects your business and keeps debt manageable.

5. Maintain a Flexible Payment Plan

Smart entrepreneurs lock in predictable loan structures when possible. If you use variable‑rate financing, build contingencies into your cash flow plan to hedge against interest rate hikes.

Understanding your repayment schedule and aligning it with revenue cycles ensures you never get caught off guard.

Final Thoughts: Funding Fuels Growth—When Used Wisely

Your business ambition deserves the right kind of support. With the diversity of loan products and funding models available today, there’s never been a better time for entrepreneurs to secure capital intelligently.

A smart funding strategy:

- Maximizes growth opportunities

- Reduces risk

- Improves long‑term financial health

- Keeps your business adaptable

Start by identifying your goals, evaluating your options, and choosing funding that aligns with both your vision and cash flow realities. With the right approach, loans and funding become powerful tools that bring your business goals within reach.